Journals are essential for businesses to keep their finances in check. They are used to keep records such as budgets, investments, incomes, and expenses.

In this article, we’ll discuss the different types of financial journals, including the Purchase Journal, Purchase Returns Journal, Cash Disbursements Journal, Cash Receipts Journal, General Journal, Sales Journal, and Sales Returns Journal. That way, employees can ensure their books are balanced and that they’re making a profit.

Purchase Journal

In the Purchase Journal, you can find all credit purchases of goods or inventories. But it shouldn’t hold within it transactions like the purchase of assets.

This financial journal is specifically for recording goods or inventories, so buys made by way of cash payments should never be held here.

For this journal, it’s important to know what credit purchases are. Paying for something on credit means that you can pay for it at that exact time or sometime after.

An example of this is when you tap your card on a transaction machine. Your bank pays for the commodities straight up, with the actual payment being taken sometime later. Businesses give credit purchases for the reason of lowering the threshold of the buy, which, in turn, increases revenue. In a business-to-business company (B2B), they will give their goods or services by way of a credit purchase with the invoice being received afterward.

There are many ways to use credit purchases, which are contained in the Purchase Journal. They can be used for paying for pricey items that you cannot afford at that time but can pay for afterward. Another is to purchase goods on an account with interest.

Credit cards only give a short time for debts to be paid. Therefore, if you’re not keeping note of your expenses, you can prolong the time of your debt payment. This is why a Purchase Journal comes in handy—to keep a record of your credit purchases.

Purchase Returns Journal

The Purchase Returns Journal holds every return of inventory that was bought with credit. However, payments made by cash can’t be recorded in this journal.

Cash Disbursements Journal

With this financial journal, also known as the Cash Payments Journal, all payments made to creditors are taken down. What’s included here is a broad range of expenses, including suppliers’ bills, interest on loans, mortgage payments, and payrolls.

Businesses hold journals specific to the type of expense group. This allows them to detect what their costs are more accurately and efficiently.

Cash Receipts Journal

Keeping a Cash Receipts Journal allows you to store all cash receipts. These could be from payments that customers make for your products or services.

Origins of cash are kept here, such as income, loans, and debtors. In this journal, you can also find stored deposits from the bank and payments made by customers.

Another purpose of a Cash Receipts Journal is to keep records of every transaction where cash sales, receipts of bank loans, and payment on accounts receipts are concerned.

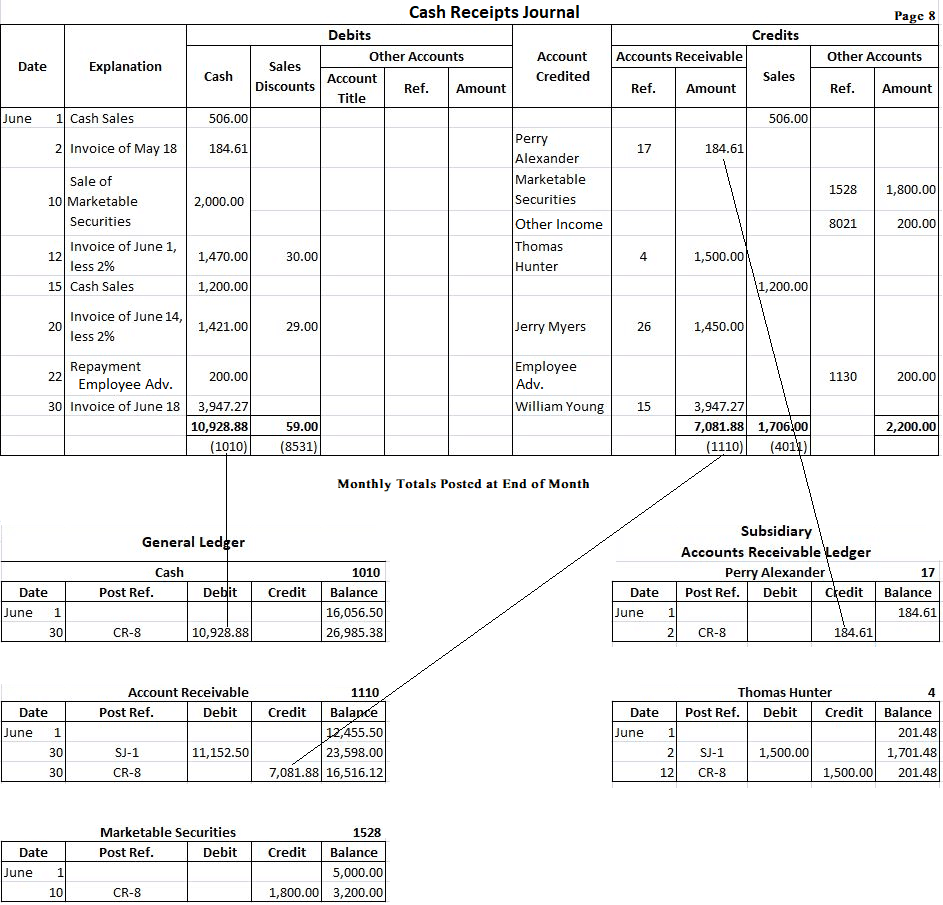

Numerous columns of cash receipts are depicted in the photo below:

Image from financestrategists.com

In the debits column, for example, there will be a sales discount column and a cash column. Another debits column goes by the name of the other accounts column. There are three sections to it: a column for the account name, one for the amount, and the other focusing on the post reference. If wished, the region for the name can be substituted for the region of account numbers.

Sales and accounts receivable are two components generally found in a credits column.

All of this is to show how cash receipts are an important segment of the Cash Receipts Journal for tracking finances.

General Journal

In the General Journal, you’ll find journal recordings in chronological order that don’t have a place in any other financial journal. The purchase of an asset by credit is one such entry that could be included here.

An entire accounting system can also be found in this journal, as all notes about credits and debits are fully compiled.

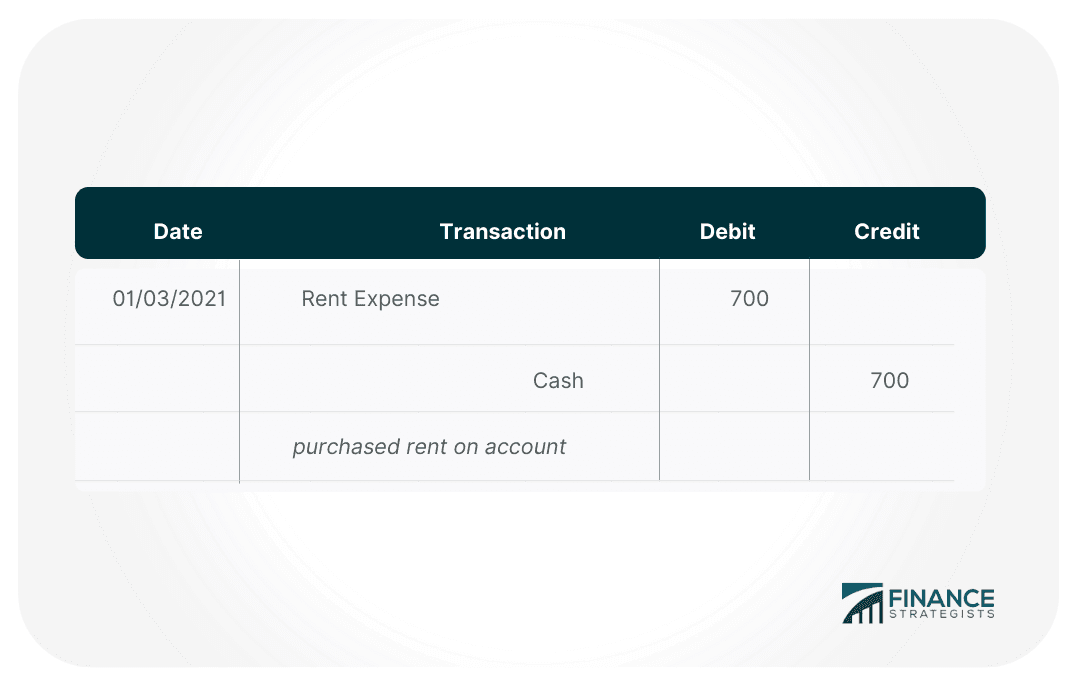

Take a look at what a journal entry might look like:

Image from financestrategists.com

This journal also goes by the names of the chronological book, book of entries, or daybook. Two components are kept within, which are in line with the double-entry system, a system in accounting. Two types of bookkeeping are important in this journal: the single-entry system and the double-entry system. When a transaction is examined, it’s held in a book—the General Journal. A journal entry is when a transaction is noted down. Journalizing is what this action is known as.

The General Journal is one of business equities. Not all transactions can fit into this diary—buys, sales, or cash payments, for example, have their place elsewhere. Instead, what you’ll find is a purchase or sale of return, the majority of adjusting entries, and several accounts of compound entries.

Sales Journal

Sales Journals keep records of all sales of goods on credit. However, sales of commodities made by customers in cash payments should always be marked in the Cash Receipts Journal and not the Sales Journal.

Sales Returns Journal

In the Sales Return Journal, every credit return for goods should be kept. In addition, if anything was bought in cash but returned by credit, it should be placed in the Purchase Returns Journals instead.

Conclusion

Now you know the different types of journals that businesses use to keep records of financial transactions. Each journal has unique entries to them, which are recorded in that exact place for specific purposes. Here, we’ve shown you what they are and how a business can use them to ensure they’re kept up to date with their finances. If you’re a business owner, employer, or entrepreneur, you’ll want to make sure to use all of the journals so that you know exactly where your finances are at.